Real-world results

No Hype. Built on Proof, Not Promises.

The Opportunity: Price Per Share

Selling discounted shares at $0.15 per share

24 month expected ROI

1,187% ROI ($1.93 ÷ $0.15)

These projections are illustrative and for discussion purposes only. They are not a promise of future performance, valuation, or terms, and they depend on factors including growth, retention, unit economics, market conditions, and financing environment. The "Base Tech Value" and multiple assumptions reflect current management estimates and common private-market heuristics; actual pricing may differ. Transaction revenue is excluded from the multiple for conservatism. This is not an offer to sell securities; any offering will be made only pursuant to definitive documentation.

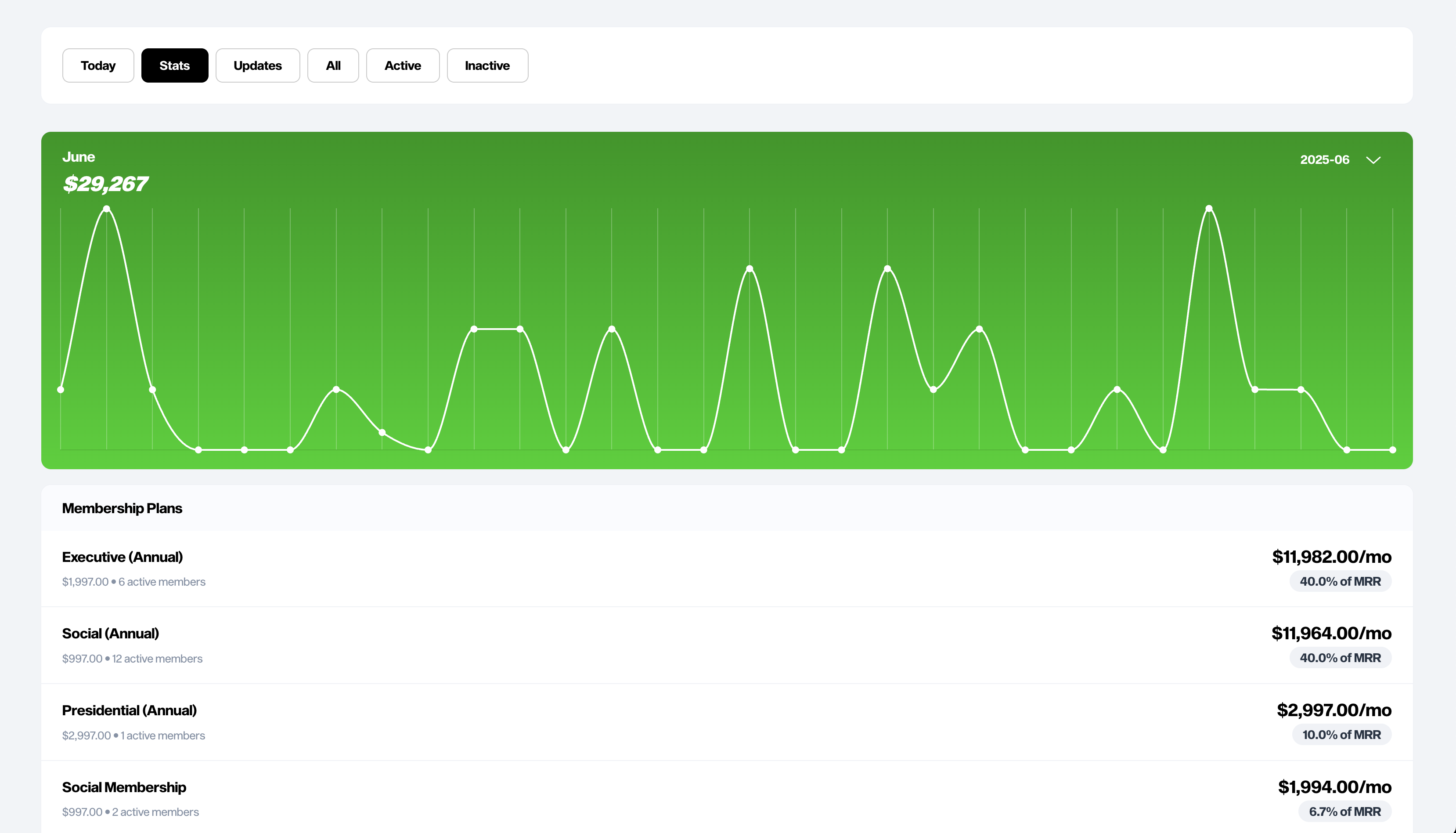

Grow your automotive club or membership service with a complete subscription & amenity operating system.

Pocket ClubOS empowers you to manage recurring revenue, automate member experiences, and unlock deeper community engagement — all from one place.

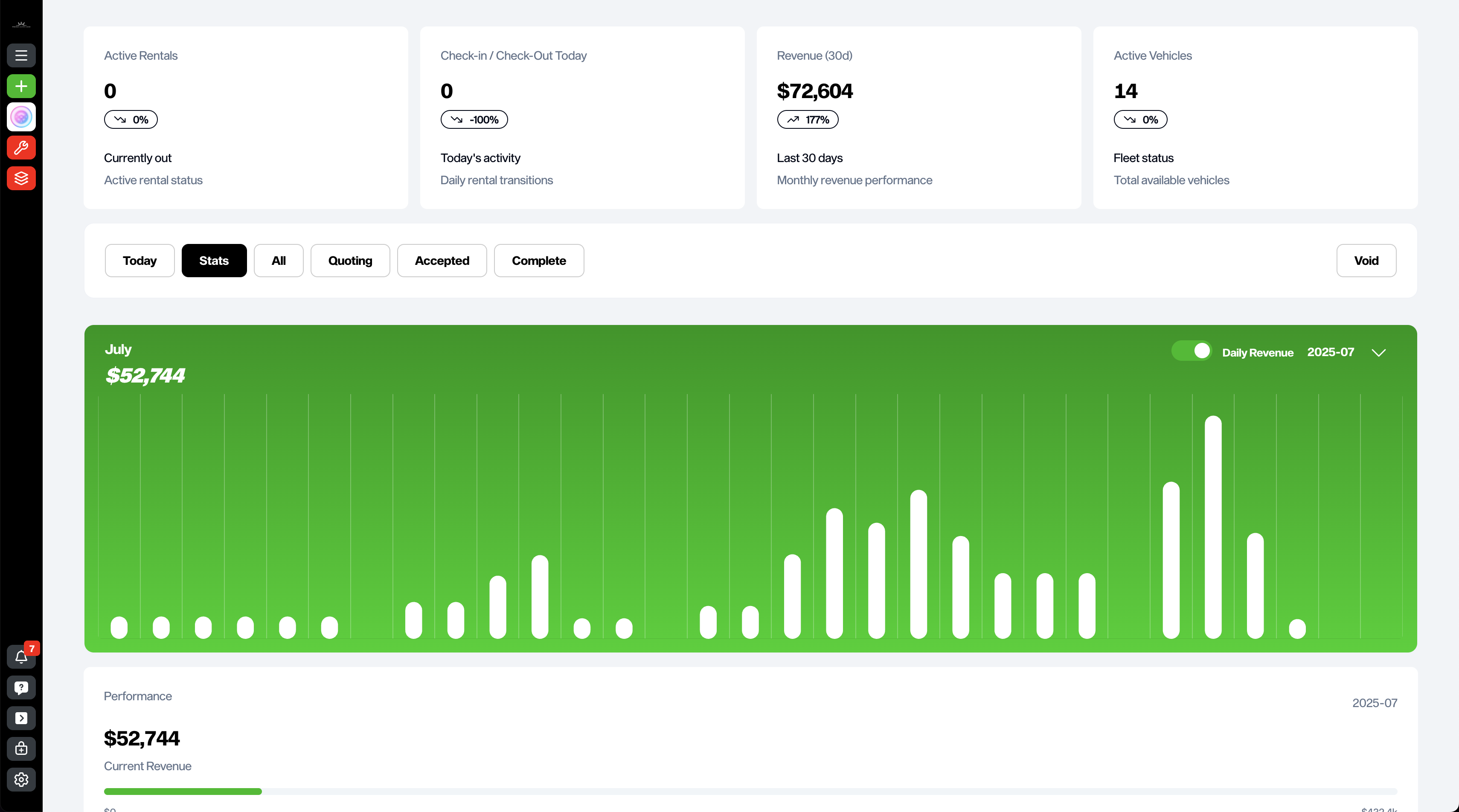

Powering the Future of Car Rental Management

Run your entire car rental business using Pocket RentalOS. More than just a tool for managing bookings, RentalOS now connects every operational element from renter verification to consignment payouts—into one seamless ecosystem

Growth Model

Customer Acquisition Cost: $200

Customers Needed: 2,000

Total: $400,000 - $150,000 of self funding = $250,000

The Raise

Legal, Disclosures & Methodology

Offering Structure

This offering is being conducted pursuant to a Simple Agreement for Future Equity (SAFE) at a post-money valuation cap of $4.05 million, equivalent to approximately $0.15 per share under a traditional priced equity round. The SAFE carries no discount and is intended to mirror a fixed-price equity investment.

Investor Eligibility

Participation is limited to accredited investors as defined under Rule 501 of Regulation D and certain individuals qualifying under the Section 4(a)(2) private-offering exemption. This presentation is not a public solicitation and is intended solely for individuals or entities with whom the company has a pre-existing relationship.

Private Placement Notice

The securities described have not been registered under the Securities Act of 1933 or any state securities laws and may not be offered or sold absent registration or an applicable exemption. All investments are subject to company acceptance and execution of definitive agreements.

Forward-Looking Statements

This presentation contains forward-looking statements that reflect current expectations, projections, and assumptions about future events. Actual results may differ materially due to various risks and uncertainties. Nothing herein should be construed as a guarantee of performance, a forecast, or an offer to sell securities to the general public.

Use of Funds

Proceeds will be allocated to growth initiatives (paid acquisition, brand marketing, and sales enablement to accelerate host and renter adoption) and debt refinancing (reducing monthly obligations so more operating capital goes toward scaling the platform).

Valuation Methodology

We model valuation as Base Tech Value + SaaS Multiple on Annualized MRR.

- Base Tech Value: $4.0M floor reflecting our current product, IP, and go-to-market foundation (early-investor incentive; management view $4–6M).

- SaaS Multiple: 10× applied to Annualized MRR (MRR × 12). This excludes transaction "gravy" (processing/marketplace fees) for conservatism.

- Growth Path: MRR grows from $7,500 to $400,000 over 24 months via ~18.02% MoM compounding.

- Customers Basis: Average customer value $49.99/week ≈ $199.96/month; customer counts per month are MRR ÷ $199.96 (rounded up).

- Share Math: 27,000,000 total shares; Price/Share = (Base Tech + 10× Annualized MRR) ÷ 27,000,000.

Why conservative: We use 10× as the baseline despite SaaS (especially with a real AI component + strong growth/retention) often commanding higher revenue multiples in favorable markets.